Start a Successful Cryptocurrency Exchange Business using 7 steps.

Are you looking to start a cryptocurrency exchange business? There is no better time like now!! Learn how. The global cryptocurrency exchange market is expected to reach $1.40 billion in 2021, reflecting a CAGR of 6.18% as per Markets and Markets report.

Source: Markets and Markets

The rise in the cryptocurrency market has increased the demand for cryptocurrency exchanges. Venture capitalists are keen on investing in crypto exchange startups.

This blog provides an in-depth blueprint of starting a cryptocurrency exchange business from scratch.

Let’s learn how!

Cryptocurrency Exchange: How and what

What is a cryptocurrency exchange online platform? It is a platform where you can exchange cryptocurrency or digital currency to fiat money or other assets. A few US-based common cryptocurrency exchanges are Coinbase, Bittrex, and Kraken-Bitcoin. In Europe, some popular digital currencies are Kriptomat, Coinmama, and Coinbase. The cryptocurrency exchange is divided in three parts: Centralized, Decentralized, and P2P exchange.

Let’s understand in brief:

-

Centralized Exchange:

This type of exchange includes an intermediary between buyers and sellers. The middleman handles all transactions and ensures credibility. The intermediary charges 0.1-1.5% of the trading fee in exchange.

-

Decentralized Exchange

No third party or mediator is involved in this type of exchange. Centralized exchanges are more secure, lack liquidity, and are not prevalent among traders.

-

P2P Exchange

Peer-to-peer exchange allows buyers and sellers to eliminate third-party involvement. In the case of Dispute, an intermediary comes into play for redressal.

Cryptocurrency exchanges work similarly to the stock exchange. Investors register an account with an exchange and, once registered, can buy and sell cryptocurrencies at the market value at a particular time. Crypto is a bit different from the stock exchange as it does not set prices. Intermediaries and prices are determined by the supply and demand of assets. Other differences are in terms of assets traded, market maturity, market reach, volatility, fees, and regulations. A crypto exchange allows 24*7 trading compared to a stock exchange that is open for selected hours.

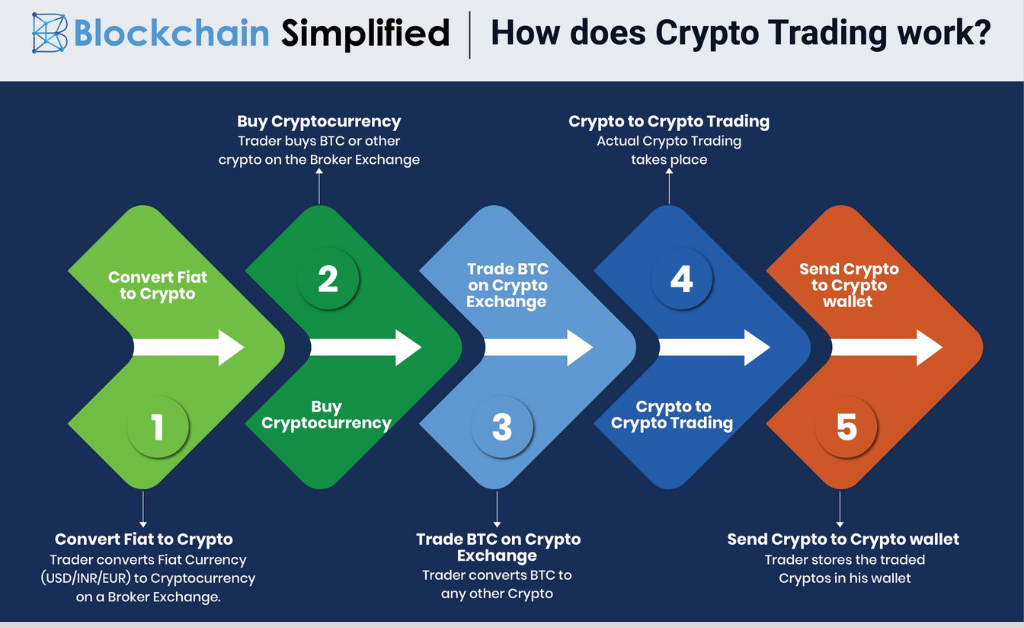

How does cryptocurrency trading work?

Source: Blockchain Simplified

Crypto trading includes theorizing cryptocurrency price movements, and it involves taking positions with the aim to generate profits. The trading process is quite similar to stock exchange trading. Here, you can transfer coins like Bitcoin and Ethereum to exchange accounts and invest in choice assets. Without a wallet, you can purchase coins directly from the exchange. You can trade coins and exchange them for assets like Ethos and Monero. You can cash your coins for profit just trade the assets back to coins like Bitcoin and transfer them to a crypto digital wallet.

Complete Guide to Start a Cryptocurrency Exchange Business

Here is the complete guide to starting a cryptocurrency exchange business from scratch.

-

Determine the Type of Exchange

There are three types of cryptocurrency exchange: centralized, decentralized, and P2P. Each exchange set has its own set of pros and cons. Decentralized exchanges are more secure, and centralized exchanges are more liquidating and prevalent. It is very important to understand the risks and benefits of each exchange and make a decision.

-

Be Sure to Meet the Legal Requirements

Scaling globally is lucrative. You can either run a crypto exchange in your country or function worldwide. But scaling globally comes with compliance requirements and regulations. The governments of all countries want you to stick to the know you customer (KYC) protocols while starting an exchange business in particular.

GKMIT recommends that you work with compliance terms and ensure that regulatory hurdles don’t block your business operations.

-

Gain Venture Funding

Well, getting venture funding is optional, but the question is, why not? 2022 is the era of the crypto market, and it is all-time high, and investors are always looking for investing opportunities. If you have a promising business model, you can easily attract venture capital and kickstart your business.

-

Work with a well-known Crypto Wallet Development Company

Developing a cryptocurrency exchange platform is a time and resource-consuming task. For this, you will need subject matter experts, C-suite executives, blockchain developers, analysts, financial advisors, and crypto marketing experts. Developing a crypto exchange platform in-house is not a feasible task, especially in the case of a startup or solopreneur who has a limited budget. GKMIT can help you develop a crypto wallet development platform and provide tailored solutions and help meet your dream to reality.

-

Partner with a Payment Processor or Bank

Partner with a payment processor like a bank to exercise the payments once the crypto exchange is ready. Choosing the right partner and the wrong payment option can break your exchange operations. Be sure to spend enough time finding a trustworthy payment processor with robust online transaction capabilities.

-

Create Liquidity

Your cryptocurrency exchange will require liquidity to operate successfully. Lack of liquidity is a common issue and generally faced by enterprises running on a decentralized model. Follow these recommendations to boost liquidity.

-

Inculcate buying and selling between two artificial accounts and simulate trading activity

-

Connect your exchange to another by implementing API

-

Integrate multiple cryptocurrency exchanges. This will bind liquidity altogether.

-

Ensure high-end Security

One of the major concern of people refraining from trading cryptocurrencies is security. Ensure your exchange portal provides top-notch security and protection to trader’s data and funds.

In 2014, a Tokyo-based bitcoin exchange trader named Mt.Gox filed for bankruptcy, claiming that hackers stole his bitcoins worth $460 million from its coffers. At that time, bitcoin was about 1% worth. This incident disrupted the cryptocurrency market and doomed digital currencies.

Thanks to high-security features and technological enhancements, the cryptocurrency gained trust and boomed again over the years. But for cyberattackers, cryptocurrency remains a juicy target. It is very important to prioritize exchange security.

-

Offer World-Class Customer Support

We live in a customer-focused market where customers have too many options to provide high-quality support. Encourage customers to stick loyal for a long time by offering excellent support and service.

Conclusion

If you are planning to start a cryptocurrency business, it is the right time. The competition in the market is growing, and soon it will be saturated in the market with no room for new entries. Start working on brainstorming ideas and developing a cryptocurrency exchange business plan. 2022 era is the new bombing era of cryptocurrency and blockchain.

Related Blogs –

Earth Day With Gkmit Invest In Our Planet As Its The Only Earth Weve Got

10 Small Business Marketing Campaign Ideas And Tips

How Manufacturing Companies Gain Value From Business Intelligence Platform

Why Are Python And Machine Learning Soulmates